scroll down

2.157

billion

euro gross turnover

5

.

5

million

loyal customers

with a customer card

in the Netherlands and Belgium

17,000

employees

employed at HEMA on average in 2024

of which +/- 6,500work for franchisees

employees working at HEMA

on average in 2024

shops

HEMA office

distribution centres

support offices in Belgium, France, Germany

buying offices in Hong Kong, Shanghai, Bangladesh and Turkey

8.720

617

543

60

60

our value chain

HEMA designs, sells and distributes products through its own shops, franchisee shops, webshops and through collaborative partners. What does that chain look like from design to the customer? How does a product last as long as possible and what happens after use?

affiliated companies

In 1958, HEMA was the first Dutch company to use franchising to accelerate the growth of HEMA shops in more and more Dutch municipalities.

In this way, the number of HEMA shops grew rapidly and HEMA became accessible to more and more customers. In 1977, half of the Dutch HEMA shops were an 'Affiliated Company', as we call a franchise shop at HEMA. And that ratio has remained more or less the same ever since. Most of today's entrepreneurial families started their partnership with HEMA back in the 1960s, with many 3rd or 4th generations now at the helm.

value creation model

Our value creation model clarifies where and how we add value in our operations and in the chain.

Besides financial capital, we deploy people and resources. The value creation model shows the results we achieve through this and our longer-term impact.

our sustainability strategy

Better everyday life in a better world We work on this every day at HEMA. This is what we base our organisation and way of working on. We are moving from a company that does sustainable things to a sustainable company.

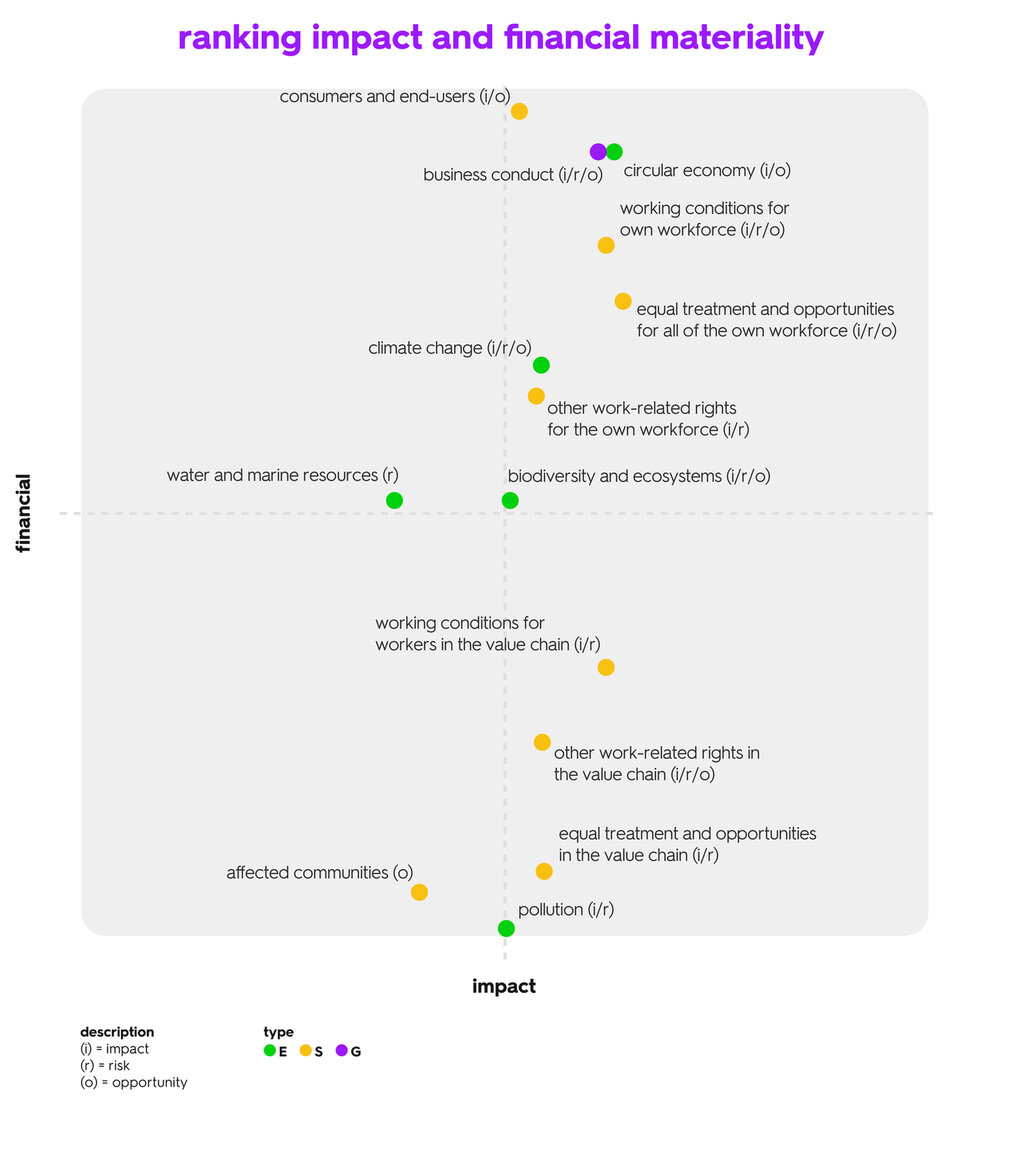

To keep ourselves constantly up to date and provide everyone with an insight into our sustainability objectives and performance, HEMA uses the European Union's reporting directive as a guide. CSRD reporting is done according to the 'European Sustainability Reporting Standards' (ESRS), which are based on the idea of 'double materiality'. This means that we determine both the important (material) social issues that affect HEMA, as well as the social issues that affect HEMA.

Preparing for reporting according to the CSRD ensured that we further sharpened our sustainability strategy. In our connectivity matrix, we have made this visible. Despite developments in 2025 changing this CSRD guideline, HEMA continues to implement our sustainability strategy. Indeed, with the double materiality analysis, we identified which issues are important to us and to our value chain. And we want to work on that.

stakeholders and interested parties

Working together with our affected and interested parties (also known as 'stakeholders') is essential to bring our mission to life. Together with suppliers, partners and civil society organisations, we make a positive impact on people and the environment. By engaging in open conversation, we stay up to date on improvements and opportunities. This way, we work on products that are not only smarter and more sustainable but also accessible to everyone. We ensure that corporate responsibility is not something extra, but a natural part of HEMA's sustainable business.

The double materiality analysis is a way of defining the most important issues for HEMA, both HEMA's impact on the world around us, and vice versa. Dialogue with our stakeholders gives us valuable insights into our impacts, risks and opportunities in our value chain.